Day 27: Should I Save for Tomorrow or Live Today? – 30 days, 30 episodes

Today, I share my uncomfortable truth about money and how I manage it as I navigate life. Should I be saving for the future or enjoying the present? Growing up with a father who worked multiple jobs instilled a strong awareness of financial stability. However, as I hit my 40s, I wonder if I'm living life to the fullest while still being safe with my finances. I share my internal struggle about spending versus saving, especially considering what it means to truly enjoy my life now rather than deferring all gratification to an uncertain future.

How can we make the most of our resources while also ensuring we’re not just waiting for the end of our lives to enjoy what truly matters?

Takeaways:

- Life is too short; we shouldn't waste time and should pursue what we love.

- It's crucial to find a balance between saving for the future and enjoying life today.

- I often avoid spending money on experiences because I fear running out later.

- Middle age comes sooner than we think, so it's important to live fully now.

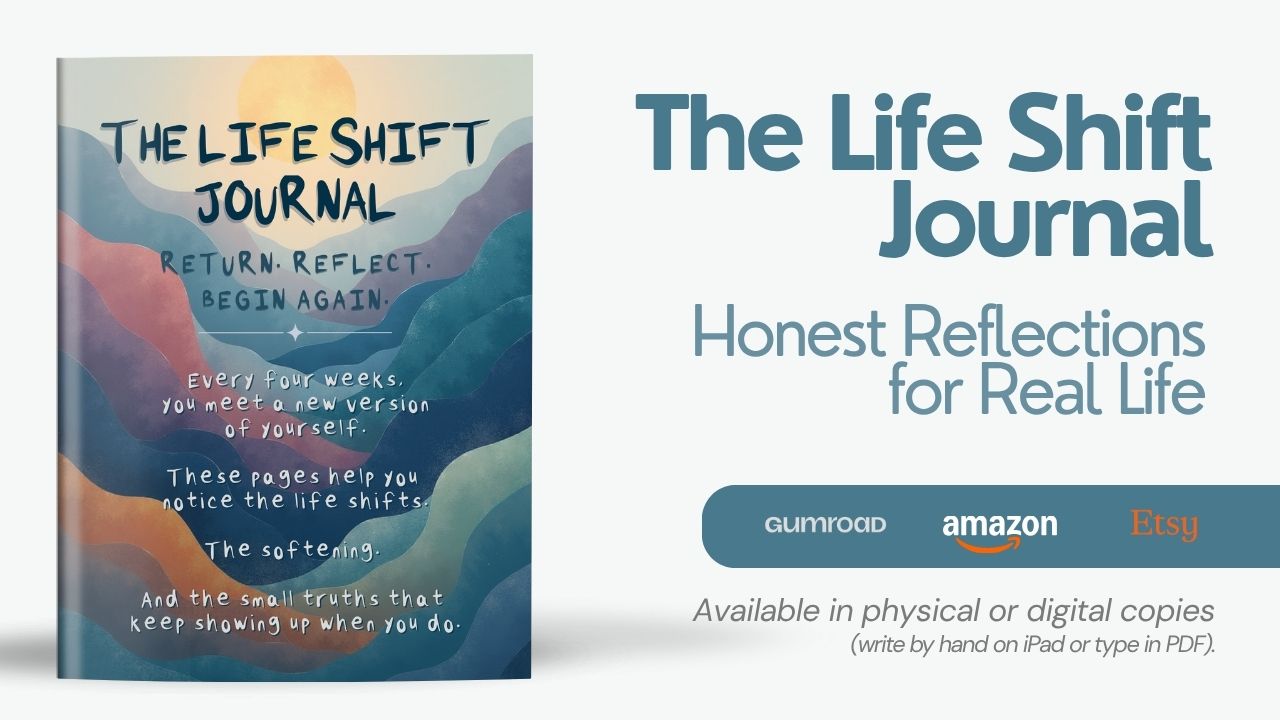

Resources: To listen in on more conversations about pivotal moments that changed lives forever, subscribe to "The Life Shift" on Apple Podcasts or wherever you listen to podcasts. If you enjoyed this episode, please take a moment to rate the show 5 stars and leave a review! ⭐️⭐️⭐️⭐️⭐️

Access ad-free episodes released two days early and bonus episodes with past guests through Patreon.

https://patreon.com/thelifeshiftpodcast

Connect with me:

Instagram: www.instagram.com/thelifeshiftpodcast

Facebook: www.facebook.com/thelifeshiftpodcast

YouTube: https://bit.ly/thelifeshift_youtube

Twitter: www.twitter.com/thelifeshiftpod

LinkedIn: https://www.linkedin.com/company/thelifeshiftpodcast

Website: www.thelifeshiftpodcast.com

This podcast uses the following third-party services for analysis:

Podcorn - https://podcorn.com/privacy

I'm Matt Gilhooly, and this is the Life Shift Candid conversations about the pivotal moments that have changed lives forever. Hello, my friends. Welcome to day 27 of 30 Days, 30 episodes of the Life Shift podcast.This is a bonus series that I am challenging myself to do in the month of November.And basically what I have been doing and what I will continue to do for the next couple days is to show up every day and record a bonus mini episode thing where I address a prompt or a question or something that's on my mind. And it is a stream of consciousness. If you've been listening, you've heard that, so you're welcome.I'm sorry, I'm not quite sure which way to go there, but it really has been quite a little adventure.I think on the last day, I will reflect upon the journey and the things that I've learned and what I will take forward with me and maybe the things that I will leave in the past. So today I was asking my friend Michelle, like, what should I talk about?Everything she was suggesting I either did already or I will address in that final episode that I mentioned.And then I started thinking about some of the habits that I have as it relates to kind of like being in my 40s and thinking about money and thinking about what does the end of life look like? Not in a morbid way, but just like, am I doing enough now so that I don't have regrets or things like that towards the end?And then before I was jumping on here to record, I was scrolling through Instagram, I think, and a friend of mine from way back when, back when I was in high school, we worked at Sam Goody, if you remember that, in the mall, we worked there together. Beth had something on her story, so. So shout out to Beth. And it was something that kind of like, fit what I was thinking at the very moment.So it felt kind of appropriate to talk about today. And basically, it is a Instagram post that says an uncomfortable truth you might need to hear. The Average lifespan is 76 years.Middle age isn't 50, it's 38. The days are long, but the years are shorter than you think. If something doesn't feel right, don't settle. Don't finish crappy books.You don't need to. Don't waste your time. Eventually, the only thing you will regret is not doing more of what you love. This is your life. This is it.And I was like, oh, wow, that really kind of fits. What kind of what I was thinking. And so I figured, why not talk about it.So, growing up, after my mom died, I remember that my dad would work additional jobs on top of his regular job, whether that was newspaper delivery when I lived in Georgia, and, you know, hopefully CPS doesn't come for us, but there were times when it was just me and my father and he would have to deliver at like 5:00 in the morning or 4:00 in the morning or. And he had to go even earlier to go bag the Atlanta newspaper. And there were times in which he didn't have anyone to stay at home and watch me.So he woke me up around 2, 3 o'clock in the morning, which I thought was so cool.And we would go to the newspaper place and we would start bagging all the newspapers and then we would throw them into his Pontiac Grand Am and we would throw them out the window or throw them in front of people's houses the way you're supposed to, of course. And I just thought it was the coolest thing.But I never really associated the fact that my dad worked a regular 9 to 5, but he was also doing this and he was also working in retail during the holiday seasons. And so he could have enough money to afford to buy the presents that he wanted to buy everyone and those kind of things that went along with it.And so money was always something like, top of mind for him, obviously, but it also kind of trickled through to me. And when I started making my own money, I started hoarding that money, which I guess is not a bad trait.And I would just be really cheap to the point that my dad used to say how tight I was with my money and how I didn't want to spend it. And like, I feel like that still kind of exists.Like, I'm afraid of running out of money and I have money saved and I have, you know, all the things I'm doing, like, what's appropriate. But which leads me into this thing. Like, how much time do we have left? Am I spending enough of my money?Like, everyone always talks about saving for retirement. At some point you're not going to work and then you're going to live and you're going to need to live on the money that you have saved.But at the same time, should we be spending some of that money now in the living part and not like just surviving at the end? I don't know. But I. I have this back and forth these days, and maybe it's something about being in my 40s.I don't know what it is, but some Days I'm like, yes, I'm just gonna spend all the money on all sorts of things. And then on other things, I'm really cheap. Like, I told you about my birthday trips to New York.It's like my favorite game to see how cheap I can make my New York trip to the point where sometimes we get not so great Broadway seats or, you know, the hotels. Meh. But at the same time, I'm like, I could be using that money for something else, but am I using that money for something else?So I need to find a nice rhythm in which I feel like, okay, this is the allotted amount of money I should be spending to kind of live my life and enjoy the things. Now I feel like in my 40s, it's going to be a lot more enjoyable to do some of these things than maybe when I'm in my 70s or my 80s. So I don't know.I don't know if this is unique to me. It seems like it might not be.And I know a lot of people have money issues, and I'm always afraid that I'm going to or, you know, I had a job for years in which I was making very little money, essentially kind of making the money that I was spending every month. And that didn't feel great.But now that I'm in a space in which maybe I can get things for myself here and there, and I can dip into savings or I can dip into something else, maybe I should. What do you think? I don't know. Maybe I'm just like, off the wall craz right now.But I thought it's kind of weird that I'm thinking about this now, about money and about how much I should be spending. Should I be spending as much money as I can? Like, what if I die tomorrow? Like, where's.I don't have kids, so it's not like that money's going to anyone. So what do I do? Maybe you have some advice of, like, instead of saving everything, like, Matt, go do this.Go whatever, spend all the money doing this.This is the best way to spend your money and I'm not going to just donate it to you because, you know, I'm still really tight with my money and cheap, so I'm just going to give it to you. Although I did give another podcaster a little bit of cash today because I. I love what she's doing.But in any case, that is what is top of mind for me today as we go into Thanksgiving. Maybe a poorly timed episode here of being grateful for the ability to save money, I don't know, but not spend it. It's just me being honest here.I think that moving forward I need to make a better plan of of how money is saved versus how money is spent because I think I am avoiding fun things or things that I might quote unquote want because I've been conditioned that I need to save it for the end because I don't want to run out of money at the end. So who knows, maybe you have some insight into this.Maybe you want to check out this little uncomfortable truth here where it reminds us that we shouldn't waste our time. Also, this is our life and this is it. So maybe not save it all to the end. That's it for today. That is day 27.A big mess stream of consciousness conversation about Am I doing enough? Am I living enough of my life? Am I spending the money that I should be to enjoy the things that I want to?Or should I be saving all of this money until the end? And hopefully that keeps me going for a long time? It's a waffle. So if you have any advice, send it my way.Unless you're a financial advisor, you're going to tell me to do the things I already know that I should be doing. So that's it. Day 27 tomorrow is Thanksgiving.So I am going to show up at some point tomorrow before I go out to my friend's parents house for Thanksgiving dinner and spend time with them. So look for an episode tomorrow.I guess I should really really focus tomorrow and make that episode about being grateful and what I am thankful for right now. I'm thankful for you.Thankful that you are listening to these bonus episodes if you are, and thankful for the Life Shift podcast and all the generous guests that I to speak to. More on that tomorrow. Have a wonderful Wednesday evening. I will see you on Thursday, Thanksgiving Day.For more information please visit wwifeshiftpodcast.com.